E&E and Semiconductor Manufacturing Insurance Malaysia

P&E insurance programme for semiconductor fabs, E&E assembly plants, and electronics manufacturing in Penang, Kulim, and Kedah. EEI, IAR, MB, BI, and cleanroom coverage explained.

Malaysia's electronics and electrical (E&E) sector accounts for nearly 40% of the country's total exports, with over 200 semiconductor and electronics manufacturing facilities concentrated in Penang, Kulim Hi-Tech Park, Kedah, and the Klang Valley. These facilities house some of the most valuable production equipment in any manufacturing sector: a single EUV lithography machine costs over USD 150 million, and a modern wafer fab's total equipment value can exceed RM2 billion.

This guide maps the complete property and engineering (P&E) insurance programme for E&E and semiconductor manufacturers in Malaysia, from cleanroom protection to machinery breakdown to the business interruption exposures that make this sector uniquely high-stakes.

This guide covers:

- Why E&E and semiconductor factories face extreme P&E risk concentrations

- The complete insurance programme by coverage type

- Electronic Equipment Insurance (EEI) for production and cleanroom equipment

- IAR coverage for building, cleanroom infrastructure, and stock

- Machinery Breakdown for process equipment and utilities

- Business Interruption and supply chain interdependency exposure

- Premium factors and cost drivers for semiconductor facilities

- Real claim scenarios from E&E manufacturing operations

- Cleanroom-specific insurance considerations

Why E&E and Semiconductor Factories Face Extreme Risk Concentrations

Semiconductor and electronics manufacturing creates a unique insurance challenge: extremely high asset values concentrated in highly sensitive environments. A cleanroom that costs RM500M to build and equip can be contaminated by a particle count exceedance that would be invisible in any other factory. A power fluctuation measured in milliseconds can scrap an entire wafer batch worth RM2M.

The E&E sector also faces supply chain interdependency risk that amplifies every physical loss. If your facility is one of three global suppliers of a specific chip, a fire that takes you offline for 6 months doesn't just cost you revenue. It disrupts the entire downstream supply chain, triggering contractual penalties and customer migration that can take years to recover.

| Risk Category | E&E-Specific Exposure | Why Severity Is Extreme |

|---|---|---|

| Fire | Chemical storage (solvents, acids, gases), electrical systems, lithium battery storage | Cleanroom HEPA systems spread smoke/soot contamination beyond fire zone |

| Electronic Equipment Failure | Lithography, etching, deposition, bonding, testing equipment | Equipment costs RM10M-500M per unit; 12-24 month replacement lead times |

| Contamination | Particle contamination, chemical spill in cleanroom, moisture ingress | Contamination can destroy weeks of in-process wafers and require full cleanroom decontamination |

| Power Quality | Voltage sag, frequency deviation, micro-interruptions | Process tools require ultra-stable power; millisecond disruptions scrap in-process work |

| Machinery Breakdown | Chillers, CDA systems, UPW plants, gas delivery systems | Utility systems are single-point-of-failure for entire fab operation |

| Business Interruption | Daily output value RM1-10M+; long equipment lead times | Revenue loss far exceeds physical damage; customer migration is permanent |

| Natural Catastrophe | Flood (especially Penang), earthquake (low but non-zero in Sabah) | 2017 Penang floods demonstrated flood vulnerability of E&E corridor |

Complete P&E Insurance Programme for E&E Manufacturers

The insurance programme for a semiconductor fab or E&E assembly plant is more complex than most other manufacturing sectors because of the overlap between electronic equipment, process machinery, and facility infrastructure. Getting the right coverage on the right policy prevents gaps and avoids double-insurance.

| Policy | What It Covers for E&E | Priority | Typical Sum Insured |

|---|---|---|---|

| Industrial All Risks (IAR) | Building, cleanroom structure, stock (wafers, components, finished goods) | Essential | RM50M-2B+ |

| Electronic Equipment Insurance (EEI) | Process tools, lithography, etching, deposition, bonding, testing, metrology equipment | Essential | RM100M-2B+ |

| Machinery Breakdown (MB) | Chillers, CDA compressors, UPW systems, HVAC, power distribution | Essential | RM20M-200M+ |

| Business Interruption (BI) | Lost gross profit after fire/IAR insured event | Essential | 18-36 months gross profit |

| ILOP (Increased Cost of Loss of Profits) | Lost revenue during electronic equipment repair/replacement period | Essential (pairs with EEI) | 18-36 months gross profit |

| MLOP | Lost revenue during utility machinery repair/replacement | Essential (pairs with MB) | 18-36 months gross profit |

| BPV Insurance | Boilers (if steam used), pressurised gas delivery systems | If applicable | RM5M-50M |

| Workmen Compensation (WC) | Workplace injuries to foreign workers in production and packaging | Mandatory (foreign workers) | Per employee basis |

| CGL Insurance | Third-party injury, property damage from operations; contractor liability | Recommended | RM5M-20M per occurrence |

Get a tailored E&E insurance programme review from Foundation

Electronic Equipment Insurance (EEI) for Semiconductor and E&E

EEI is the single most important policy for E&E manufacturers. While IAR covers the building and stock, the production equipment in a semiconductor fab or assembly plant is where the real value sits. A single lithography stepper costs RM50-100M. A wire bonding line with 200 machines represents RM40-60M. The total process equipment in a mid-size wafer fab can exceed RM1 billion.

EEI covers all risks of sudden and unforeseen physical loss or damage to electronic equipment, including:

- Short circuit, electrical overload, voltage surge

- Defects in insulation, mechanical breakdown of electronic components

- Operator error causing physical damage

- Contamination damage (chemical spill, particle ingress)

- Fire, lightning, explosion (overlapping with IAR but applying specifically to scheduled equipment)

EEI vs IAR vs MB: Which Policy Covers What

This is the most common source of confusion in E&E insurance. Process equipment can potentially fall under three different policies. Getting the classification right prevents coverage gaps and avoids paying for double insurance.

| Equipment Type | Best Covered Under | Why |

|---|---|---|

| Lithography steppers/scanners | EEI | Electronic precision equipment; internal defect and contamination coverage critical |

| Etching and deposition tools | EEI | Electronic/plasma-based process; voltage and contamination are primary risks |

| Wire bonding machines | EEI | Precision electronic positioning; servo system failure is primary risk |

| Test equipment (ATE, wafer probe) | EEI | Electronic measurement systems; internal electronic defects are primary cause of loss |

| Chillers and cooling towers | MB | Mechanical equipment; compressor/motor failure is primary risk |

| CDA compressors (clean dry air) | MB | Mechanical rotating equipment; bearing/motor failure is primary risk |

| UPW (ultra-pure water) plant | MB | Pumps, RO membranes, UV systems; mechanical/process equipment |

| Transformers, switchgear | MB or EEI | Can be placed under either; depends on programme structure |

| UPS systems, generators | MB or EEI | Depends on whether primarily electronic (UPS) or mechanical (generator) |

| Cleanroom HVAC and FFU | MB | Mechanical air handling equipment |

| Building and cleanroom structure | IAR | Property insurance for physical structure including raised floors, wall panels |

| Wafer inventory, components, finished goods | IAR | Stock is property, not equipment |

The coordination principle: Foundation structures E&E programmes so that every piece of equipment and every asset appears on exactly one policy schedule. This prevents gaps (nothing covers it) and overlaps (two policies argue about who pays).

ILOP: The Loss-of-Profits Extension for EEI

ILOP (Increased Cost of Loss of Profits, sometimes called External Data Media extension or simply "consequential loss under EEI") is the loss-of-profits cover that pairs with EEI. When a critical piece of electronic equipment fails and production stops, ILOP covers the gross profit you lose during the repair or replacement period.

For semiconductor fabs, the ILOP exposure dwarfs the equipment replacement cost. A lithography stepper worth RM80M might produce RM500,000 in wafers daily. If it takes 18 months to replace, the lost production is RM270M, more than three times the equipment value. ILOP indemnity periods of 24-36 months are common for semiconductor facilities because of these extended equipment lead times.

IAR Coverage for E&E Facilities

IAR insurance covers the physical property: building structure, cleanroom infrastructure (raised floors, wall panels, HEPA ceiling grids), stock (raw wafers, work-in-process, finished goods), and general contents. For E&E manufacturers, IAR is essential because:

- Cleanroom infrastructure is expensive. Building a Class 100 cleanroom costs RM3,000-8,000 per square foot. A 50,000 sq ft cleanroom represents RM150-400M in construction value alone.

- WIP (work-in-process) is high-value. A single 300mm wafer lot in advanced processing can be worth RM1-5M. A fab may have hundreds of lots in process at any time.

- Contamination damage is pervasive. A fire in one area can spread soot and chemical contaminants through the HVAC system, damaging cleanroom environments far from the fire origin.

IAR Sum Insured Considerations for E&E

| Asset Category | Valuation Basis | Common Pitfall |

|---|---|---|

| Building + cleanroom structure | Reinstatement value (cost to rebuild to current spec) | Undervaluing cleanroom rebuild cost; construction costs have risen 30-50% since original build |

| Raw materials (blank wafers, substrates) | Purchase cost | Not updating for supply-constrained pricing (wafer costs fluctuate significantly) |

| Work-in-process (WIP) | Material cost + processing cost added to date | Declaring average WIP when peak WIP is 2-3x higher; average clause applies |

| Finished goods | Selling price or cost of production | Not accounting for high-value product mix (automotive-grade chips vs consumer) |

| Chemicals and gases | Replacement cost | Often excluded from declarations; specialty gases are expensive |

Business Interruption: The Dominant Exposure

For E&E and semiconductor manufacturers, business interruption (BI) is typically the largest component of any insurance claim. The physical damage might be RM50M, but the lost production revenue over a 12-24 month reinstatement period can exceed RM500M. This is because:

- Equipment lead times are extreme. Semiconductor process tools take 12-24 months to manufacture and deliver. You can't buy a replacement lithography stepper off the shelf.

- Cleanroom rebuild takes time. Even after physical repairs, requalifying a cleanroom to production standards takes 3-6 months of commissioning and qualification.

- Customer migration is permanent. If you can't supply chips for 12 months, your customers will qualify alternative sources. Many won't come back.

Multiple Loss-of-Profits Policies in E&E

A semiconductor facility needs up to three separate loss-of-profits policies, each triggered by different underlying events. Missing any one creates a gap.

| Policy | Trigger | Example | Typical Indemnity Period |

|---|---|---|---|

| BI (Business Interruption) | Fire, flood, explosion (IAR-insured peril) | Factory fire damages cleanroom; 18 months to rebuild and requalify | 24-36 months |

| ILOP | Electronic equipment failure (EEI-insured event) | Lithography stepper fails; 18-month replacement lead time | 24-36 months |

| MLOP | Machinery breakdown (MB-insured event) | Main chiller compressor fails; 8 weeks to replace; cleanroom temperature rises, production halts | 18-24 months |

All three are needed. A fire triggers BI but not ILOP or MLOP. A process tool failure triggers ILOP but not BI or MLOP. A chiller breakdown triggers MLOP but not BI or ILOP. Each has a different underlying policy and a different trigger mechanism.

Cleanroom-Specific Insurance Considerations

Cleanrooms create unique insurance exposures that don't exist in standard manufacturing. Underwriters who specialise in semiconductor and E&E risks understand these; generalist brokers often don't.

| Cleanroom Issue | Insurance Implication | What to Ensure |

|---|---|---|

| Smoke/soot contamination | A small fire can contaminate the entire cleanroom via HVAC | IAR must cover decontamination costs; BI period must account for requalification time |

| Water damage from above | Sprinkler discharge or pipe burst above cleanroom destroys equipment and WIP | IAR must cover sprinkler leakage damage; consider pre-action sprinkler systems |

| HVAC failure | Loss of environmental control scraps in-process wafers | MB must cover HVAC; MLOP must cover lost production during repair |

| Chemical spill in fab | Corrosive chemical damages equipment and contaminates cleanroom | EEI should cover chemical contamination damage to scheduled equipment |

| Requalification time | After repair, 3-6 months to requalify cleanroom to production spec | BI indemnity period must include requalification, not just physical reinstatement |

E&E Sub-Sector Risk Profiles

The E&E sector in Malaysia spans everything from advanced wafer fabrication to basic PCB assembly. Insurance programmes scale accordingly.

| Sub-Sector | Key Equipment | Typical TIV Range | Primary Insurance Focus |

|---|---|---|---|

| Wafer Fabrication (front-end) | Lithography, etching, deposition, CMP, ion implant | RM500M-5B+ | EEI (process tools), IAR (cleanroom), BI/ILOP (extreme revenue) |

| Assembly & Test (back-end / OSAT) | Die attach, wire bond, mould, trim/form, test (ATE) | RM50M-500M | EEI (bonding/test), MB (moulding presses), BI |

| PCB Manufacturing | Drilling, plating, etching, lamination, AOI | RM20M-200M | Fire/IAR (chemical fire risk), MB (plating/etching lines), EEI (AOI/testing) |

| Solar Cell/Panel Manufacturing | Cell processing, stringing, lamination, testing | RM50M-300M | EEI (cell processing), MB (lamination), IAR (stock) |

| LED / Optoelectronics | MOCVD, die bonding, testing, sorting | RM30M-200M | EEI (MOCVD extremely expensive), MB, IAR |

| Consumer Electronics Assembly | SMT lines, wave solder, ICT, functional test, robotics | RM10M-100M | EEI (SMT), MB (solder/reflow), Fire/IAR, BI |

Claim Scenarios: What Actually Goes Wrong in E&E Factories

Scenario 1: Wafer Fab Chiller Failure

A semiconductor fab in Penang operates three process chillers providing cooling water to the lithography and etch tools. One chiller suffers a compressor failure during peak production. The remaining two chillers cannot maintain the required temperature stability, forcing the fab to shut down 40% of process tools for 6 weeks while a replacement compressor is sourced from Germany.

| Loss Component | Estimated Cost | Which Policy Responds |

|---|---|---|

| Chiller compressor repair/replacement | RM350,000 | Machinery Breakdown |

| In-process wafers scrapped (temperature excursion) | RM8M | IAR (stock section) or EEI (if contamination damage to tools) |

| Lost production (40% capacity for 6 weeks) | RM42M | MLOP |

| Express shipping and overtime for repair | RM200,000 | MLOP (increased cost of working) |

| Total loss | RM50.55M |

The lesson: The chiller repair was RM350,000. The total loss was RM50.55M. Without MLOP, the fab absorbs over RM42M in lost production from a single utility equipment failure. This is why semiconductor companies treat MLOP as essential, not optional.

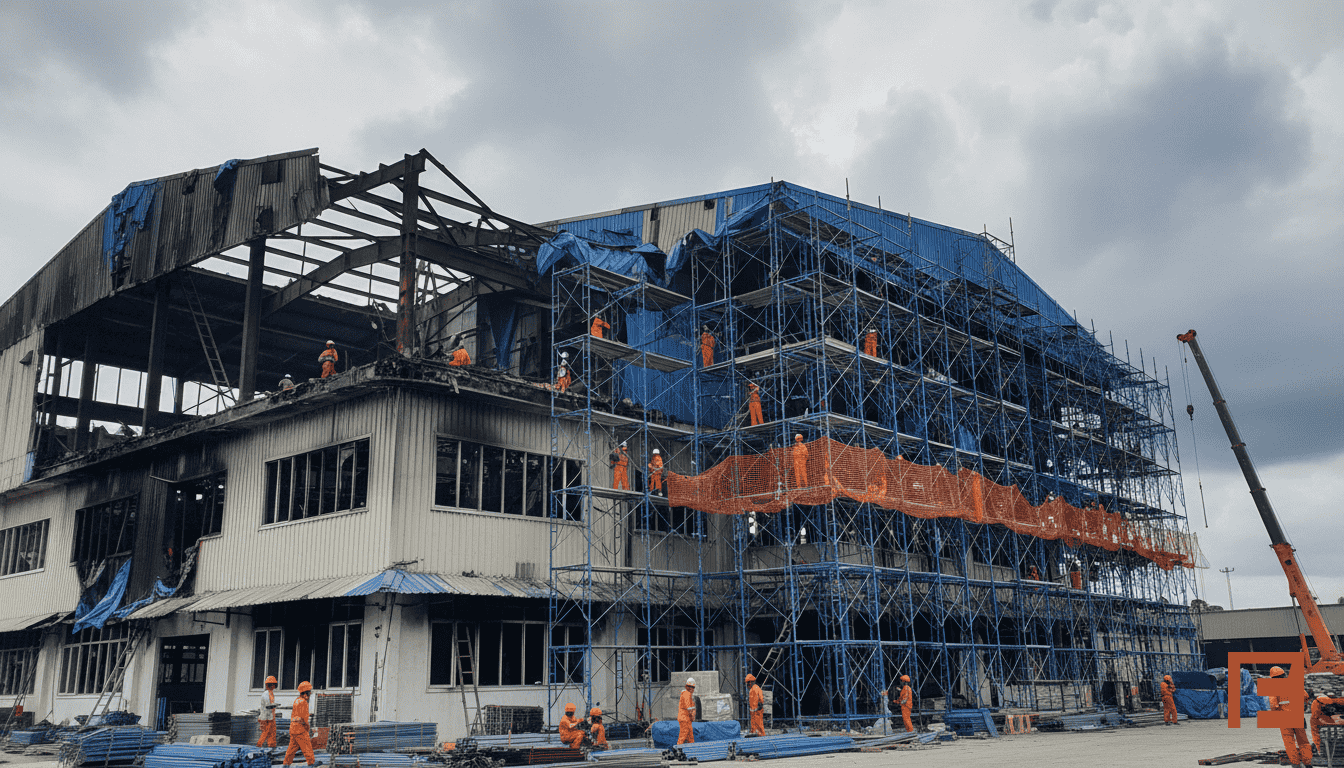

Scenario 2: Cleanroom Fire and Contamination

A fire originating from a solvent cabinet in the chemical storage area of an assembly plant spreads to the adjacent cleanroom. The fire is contained within 2 hours, but smoke and soot particles enter the cleanroom HVAC system, contaminating the entire 30,000 sq ft production area. Physical fire damage is limited to the storage area, but the contamination requires full cleanroom decontamination and requalification.

| Loss Component | Estimated Cost | Which Policy Responds |

|---|---|---|

| Physical fire damage (storage area) | RM2.5M | IAR |

| Cleanroom decontamination and HEPA replacement | RM4M | IAR (contamination/decontamination costs) |

| Equipment cleaning and requalification | RM6M | EEI (contamination damage to scheduled equipment) |

| WIP destroyed | RM5M | IAR (stock section) |

| Lost production during 4-month decontamination + requalification | RM60M | BI |

| Total loss | RM77.5M |

The lesson: Physical fire damage was RM2.5M. But contamination costs (RM10M), WIP loss (RM5M), and production shutdown (RM60M) pushed the total to RM77.5M. In E&E, the indirect and consequential costs of a fire are typically 10-30x the direct fire damage. This is why BI indemnity period must include requalification time, not just physical reinstatement.

Scenario 3: Power Surge Damages Test Floor

A voltage surge from a TNB switching event travels through the power distribution to the test floor of an OSAT facility. The surge damages 45 automated test equipment (ATE) systems, each worth RM1-3M. While the surge also trips circuit breakers across the facility, the test equipment suffers the most damage because of its sensitivity to power quality.

| Loss Component | Estimated Cost | Which Policy Responds |

|---|---|---|

| ATE repair/replacement (45 units) | RM25M | EEI |

| Power distribution repair | RM800,000 | MB or EEI (depending on equipment) |

| Lost test capacity for 3 months (phased recovery) | RM35M | ILOP |

| Total loss | RM60.8M |

The lesson: Power surges are a top cause of loss for E&E facilities. EEI covers the equipment damage, and ILOP covers the lost revenue during repair. Without EEI, a power surge to the test floor is a RM60M+ uninsured loss. UPS systems provide some protection but can't eliminate the risk entirely.

Premium Factors for E&E Manufacturing Insurance

| Factor | What Underwriters Assess | Impact on Premium |

|---|---|---|

| Equipment value concentration | Maximum Probable Loss (MPL) per fire compartment or per building | High: single-building fabs with RM1B+ equipment = highest rates |

| Fire protection | Sprinkler coverage, FM Global / HPR standards, chemical storage segregation | High: FM Global-approved facilities get significantly better rates |

| Power quality systems | UPS capacity, voltage regulation, dual-feed power supply, backup generators | Medium-High: robust power quality reduces EEI claims frequency |

| N+1 redundancy | Backup systems for critical utilities (chillers, CDA, UPW, power) | Medium: redundancy reduces MLOP exposure and improves terms |

| Maintenance programme | Preventive maintenance schedules, OEM service contracts, spare parts inventory | Medium: documented PM reduces breakdown frequency |

| Flood exposure | Flood zone, elevation, flood barriers, historical flood events | High: Penang facilities post-2017 floods face flood sublimits and higher deductibles |

| Claims history | Last 5-10 years claims, frequency and severity | High: large claims in the past 3 years = significant premium loading |

| Chemical management | Chemical storage, dispensing systems, spill containment, CIMAH compliance | Medium: poor chemical management increases fire and contamination risk |

Get a premium indication for your E&E facility from Foundation

Regulatory Compliance and Insurance Connections

E&E and semiconductor facilities operate under multiple regulatory frameworks. Several directly create insurance requirements or affect underwriting assessments.

| Regulation | Agency | Insurance Connection |

|---|---|---|

| OSHA 1994 (Amendment 2022) | DOSH | Workplace safety; penalties up to RM500,000; WC for foreign workers |

| FMA 1967 | DOSH | Boiler/pressure vessel CF for gas delivery and chilled water systems |

| CIMAH 1996 | DOSH | Major accident hazard sites (chemical quantities); fabs with large gas/chemical inventories may trigger CIMAH |

| USECHH 2000 | DOSH | CHRA requirements for chemical handling; affects CGL and WC exposure |

| Fire Services Act 1988 | BOMBA | Fire certificate compliance; fire protection system standard affects premium |

| Environmental Quality Act 1974 | DOE | Scheduled waste from chemical processes; environmental liability exposure |

| Electricity Supply Act 1990 | Suruhanjaya Tenaga | Electrical installation compliance; affects EEI and fire underwriting |

Malaysia's E&E Corridors and Location-Specific Risks

The concentration of E&E facilities in specific geographic corridors creates location-specific insurance considerations that affect coverage terms and pricing.

| Corridor | Key Occupants | Location-Specific Risk | Insurance Impact |

|---|---|---|---|

| Penang (Bayan Lepas FIZ, Prai) | Intel, AMD, Broadcom, Osram, B. Braun, Keysight | Flood (2017 Penang floods caused RM1B+ insured losses to E&E sector) | Flood deductibles RM1-5M; sublimits common; flood mitigation mandatory |

| Kulim Hi-Tech Park | Infineon, First Solar, SilTerra, ams-OSRAM | Newer facilities, generally better flood protection | Better terms than Penang flood zones; infrastructure is newer |

| Klang Valley (Shah Alam, Petaling Jaya) | Texas Instruments, ON Semiconductor, Nexperia | Flash floods (December 2021 demonstrated vulnerability) | Flood exposure varies by specific location within corridor |

| Johor (Iskandar, Senai) | Various OSAT, growing data centre presence | Flood risk in certain zones; proximity to Singapore = logistics advantage | Depends on specific estate and elevation |

Who Needs E&E Manufacturing Insurance

If you operate any of the following, you need a specialist P&E insurance programme structured by a broker who understands semiconductor and electronics risks:

- Wafer fabrication facilities (fabs) with cleanroom environments, lithography, and wet/dry process tools

- Outsourced Semiconductor Assembly and Test (OSAT) facilities with bonding, moulding, trim/form, and ATE equipment

- PCB manufacturing plants with chemical processing (etching, plating) and drilling operations

- Electronics assembly factories with SMT lines, reflow ovens, wave soldering, and ICT/functional test

- Solar cell and panel manufacturers with cell processing, stringing, and lamination equipment

- LED and optoelectronics manufacturers with MOCVD and die processing equipment

- Hard disk drive and storage component manufacturers with cleanroom assembly

The common thread: your equipment is extremely expensive, your production environment is sensitive, and your revenue per square foot is among the highest in any manufacturing sector. A generalist broker structuring your programme as "factory insurance" will miss the EEI/ILOP layer, undervalue cleanroom rebuild costs, and set BI indemnity periods that are too short for equipment replacement lead times.

FAQ

What's the difference between EEI and MB for an E&E factory?

EEI covers electronic and precision equipment (process tools, test equipment, lithography machines) against all risks including internal electronic defects, voltage surge, and contamination. MB covers mechanical equipment (chillers, compressors, generators, pumps) against internal mechanical and electrical faults. Most E&E factories need both because they have both types of equipment. The key is scheduling each piece of equipment under the correct policy.

Why do semiconductor fabs need 24-36 month BI indemnity periods?

Because equipment replacement lead times for advanced process tools are 12-24 months, and cleanroom requalification after major damage takes an additional 3-6 months. A standard 12-month BI period runs out before the fab is back in production. Foundation structures E&E programmes with indemnity periods that reflect actual reinstatement timelines, not generic manufacturing assumptions.

Does IAR cover cleanroom contamination from smoke?

Yes, IAR covers the cost to decontaminate and restore the cleanroom after a fire or other insured event. But the key issue is ensuring the BI indemnity period is long enough to cover the requalification time after decontamination. Physical repairs might take 3 months, but requalifying the cleanroom to production spec can take another 3-6 months.

How did the 2017 Penang floods affect E&E insurance?

The 2017 floods caused over RM1 billion in insured losses across Penang's E&E sector. Since then, insurers have imposed higher flood deductibles (RM1-5M), flood sublimits, and stricter requirements for flood mitigation measures. Facilities in known flood zones now need to demonstrate elevated equipment placement, flood barriers, and emergency response plans to secure coverage.

Is EEI needed for a basic SMT assembly line?

Yes, though the sums insured are much lower than a wafer fab. SMT placement machines, reflow ovens (to the extent they have electronic controls), and ICT/functional test equipment all qualify for EEI. The main benefit is covering voltage surges and internal electronic defects that MB and fire policies exclude. For a typical SMT line worth RM5-20M, EEI is a relatively inexpensive way to close this gap.

What insurance do I need during factory expansion or new cleanroom construction?

CAR insurance covers the building construction works, while EAR insurance covers the erection and installation of equipment. If the new cleanroom is being built adjacent to the existing production facility, ensure your existing IAR policy has an adequate "capital additions" clause to cover the new assets as they come online. Foundation coordinates construction-phase and operational-phase insurance so there are no gaps during commissioning.

How does N+1 redundancy affect my insurance premium?

Significantly. Having backup systems for critical utilities (chillers, CDA, power, UPW) reduces the probability and severity of business interruption losses. Underwriters view N+1 redundancy as a risk improvement measure that directly reduces MLOP exposure. Facilities with documented N+1 on critical systems typically get better deductible terms and lower MLOP rates.

Does my EEI policy cover power surge damage from TNB?

Yes. EEI covers damage from voltage surges, power fluctuations, and electrical disturbances regardless of source. This includes external power supply issues from TNB as well as internal power distribution problems. UPS systems reduce the frequency of such events but don't eliminate them, especially for high-sensitivity process tools.

What should the sum insured for WIP be in my fab?

Declare the maximum WIP value, not the average. Semiconductor WIP fluctuates significantly based on product mix and loading. If your average WIP is RM50M but peak is RM120M, declare RM120M. If you declare RM50M and suffer a loss during peak loading, the average clause reduces your claim payout proportionally.

Can Foundation handle a RM1 billion+ TIV semiconductor programme?

Yes. Large semiconductor programmes require access to international reinsurance markets (London, Singapore, Japan) because no single Malaysian insurer has the capacity for RM1B+ TIVs. Foundation works with international placement markets to structure programmes that provide adequate limits at competitive terms. The key is presenting the risk with the technical detail that specialty underwriters need.

Foundation Conclusion

E&E and semiconductor manufacturing creates the most concentrated P&E risk in any Malaysian industry. Equipment worth hundreds of millions of ringgit operates in environments where a particle count exceedance or a millisecond power fluctuation can scrap a production batch. The business interruption exposure typically exceeds the physical damage by 5-20x, and equipment replacement lead times measured in years mean standard BI periods are dangerously short.

A properly structured E&E insurance programme coordinates IAR, EEI, MB, BI, ILOP, and MLOP so that every loss scenario has a clear and adequate policy response. Foundation specialises in building these multi-layered programmes for Malaysia's semiconductor and electronics manufacturers.

Talk to Foundation's E&E insurance specialists

Disclaimer: This article provides general guidance on insurance coverage available in the Malaysian market. Policy terms, conditions, and availability vary by insurer. Always review your specific policy wording or consult a qualified insurance professional before making coverage decisions.

Unlock Exclusive Foundation Content

Subscribe for best practices, research reports, and more, for your industry

Insights on Property & Engineering Risks

Practical guidance on construction, industrial, and engineering insurance in Malaysia

Let’s Work Together

If you're managing a construction project, industrial facility, or commercial property in Malaysia and need insurance coverage, we can help structure a program that works.