Fire Insurance Flood Coverage Malaysia: Does It Cover Flood Damage? Complete Factory Guide 2026

Does fire insurance cover flood damage in Malaysia? This comprehensive factory guide reveals critical coverage gaps and provides actionable steps to protect your manufacturing facility.

Does Fire Insurance Cover Flood Damage in Malaysia?

No. Standard fire insurance in Malaysia does not cover flood damage. Fire insurance operates on a named perils basis, covering only the specific risks listed in the policy: fire, lightning, and domestic explosion. Flood is not one of those named perils.

This is the single most expensive gap in Malaysian factory insurance. When the December 2021 Klang Valley floods hit, thousands of factory owners across Shah Alam, Klang, and Rawang discovered their fire insurance would not pay a single ringgit for flood losses. Machinery submerged, stock destroyed, production halted for weeks. All uninsured.

This guide explains exactly what fire insurance covers, why flood is excluded, what your options are to add flood coverage, and how much it costs. If you own or operate a factory, warehouse, or commercial premises in a flood-prone area of Malaysia, this is the most important insurance decision you will make.

What Standard Fire Insurance Actually Covers

Malaysian fire insurance follows the fire tariff structure regulated by Bank Negara Malaysia. The standard policy covers a limited set of named perils. Everything not listed is excluded by default.

| Standard Fire Policy Perils | What It Covers | Common Misconceptions |

|---|---|---|

| Fire | Damage caused by actual fire at the insured premises | Does NOT include damage from heat without flames (e.g., overheated equipment) |

| Lightning | Direct damage from lightning strikes | Power surge from lightning may not be covered without extension |

| Domestic explosion | Explosion of boilers or gas used for domestic purposes | Industrial boiler explosions require separate BPV insurance |

That is the entire scope of a standard fire policy. Three perils. No flood, no storm, no burst pipes, no impact damage, no riot. Everything else requires either special perils extensions or a different type of policy altogether.

Why Flood Is Excluded from Fire Insurance

Flood is excluded because it is a catastrophic peril. Unlike fire which typically affects individual premises, floods affect entire geographical areas simultaneously. This creates concentration risk for insurers where thousands of claims arrive at once from the same event.

The Malaysian insurance market historically separated flood coverage from fire insurance for this reason. Flood coverage is available but only as an add-on extension called Special Perils, which must be specifically requested and paid for separately.

Many factory owners assume their fire insurance "covers everything." This assumption has been catastrophic during every major flood event in Malaysia.

Special Perils Extension: Adding Flood to Fire Insurance

The Special Perils extension adds coverage for natural catastrophe events to your fire insurance policy. It is an add-on, not automatic. You must specifically request it and pay the additional premium.

| Special Perils Coverage | What It Covers | Key Conditions |

|---|---|---|

| Flood | Water damage from overflowing rivers, lakes, canals, or natural water courses | Usually subject to separate deductible; may have sub-limit |

| Tempest / Windstorm | Damage from severe wind events | Excludes normal wear and tear from wind exposure |

| Riot, strike, and malicious damage | Damage from civil unrest and intentional destruction | Subject to waiting period in some policies |

| Impact by vehicles / animals | Damage from vehicle collision or animal impact | Does not cover vehicles owned by the insured |

| Bursting of water pipes | Water damage from internal plumbing failures | Only internal plumbing, not external drainage |

| Aircraft damage | Damage from falling aircraft or articles dropped from aircraft | Rare peril but included in special perils bundle |

| Earthquake / volcanic eruption | Damage from seismic events | Low risk in Malaysia but occasionally relevant for Sabah |

| Landslide / subsidence | Ground movement damage | Subject to survey and site conditions |

Special perils coverage is usually sold as a package. You cannot pick and choose individual perils in most cases. The entire package is either added or not. The additional premium depends on your location, flood zone classification, and claims history.

How Much Does Special Perils Extension Cost?

| Flood Zone | Location Examples | Additional Premium (% of Sum Insured) | Typical Deductible |

|---|---|---|---|

| Low risk | Elevated industrial parks, areas with no flood history | 0.02% - 0.05% | RM5,000 - RM10,000 |

| Moderate risk | Areas with occasional flash floods, near drainage systems | 0.05% - 0.15% | RM10,000 - RM25,000 |

| High risk | Shah Alam Sections 15-25, Prai, low-lying Klang areas | 0.15% - 0.50% | RM25,000 - RM100,000 |

| Very high risk / prior claims | Premises with previous flood claims, known flood plains | 0.50% - 1.00% or higher | RM100,000+ or percentage-based |

For a factory with RM20 million sum insured in a moderate risk zone, the special perils extension would add approximately RM10,000 to RM30,000 to the annual premium. Compare this to a single flood event that could wipe out RM5 million or more in machinery, stock, and building damage.

Request a free policy review →

Fire Insurance vs IAR: Which Covers Flood Better?

Industrial All Risks (IAR) takes a fundamentally different approach to coverage compared to fire insurance. While fire insurance is a named perils policy (only covers what is listed), IAR is an all risks policy (covers everything except what is specifically excluded).

| Feature | Fire Insurance + Special Perils | Industrial All Risks (IAR) |

|---|---|---|

| Coverage approach | Named perils only (must be listed to be covered) | All risks (covered unless specifically excluded) |

| Flood coverage | Only with special perils extension added | Usually included by default (check exclusions) |

| Accidental damage | Not covered | Covered (e.g., forklift hitting a wall, accidental breakage) |

| Water damage (non-flood) | Only burst pipes with special perils | Broader water damage coverage |

| Business Interruption | Available as extension (BI follows material damage trigger) | Available as extension with broader trigger |

| Premium cost | Lower base premium + special perils add-on | Higher premium but broader coverage |

| Suitable for | Simple premises, low-value stock, budget constraints | Factories with RM10M+ assets, complex operations, high-value stock |

| Claims position for flood | Must prove the peril is named and extension is active | Covered by default; insurer must prove exclusion applies |

The key difference is burden of proof during claims. With fire insurance, you must prove the peril causing the loss is one of the named perils. With IAR, the insurer must prove an exclusion applies. This is a significant advantage for the policyholder, especially for complex losses where multiple causes contribute to the damage.

For more detail on choosing between these two approaches, read our comprehensive Fire Insurance vs IAR comparison.

Malaysia Flood Zones: Is Your Factory at Risk?

Malaysia experiences monsoon flooding annually. Between 2021 and 2025, major flood events affected industrial zones across Peninsular Malaysia. If your factory is in any of these areas, flood coverage is not optional.

| State | High-Risk Industrial Areas | Recent Major Flood Events | Key Industries Affected |

|---|---|---|---|

| Selangor | Shah Alam (Sections 15-25), Klang, Rawang, Subang | December 2021 (catastrophic), recurring annual | Manufacturing, automotive, logistics |

| Penang | Bayan Lepas FTZ, Prai Industrial, Bukit Minyak | November 2017, recurring flash floods | Electronics, semiconductor, food processing |

| Johor | Pasir Gudang, Senai, Larkin | January 2023, March 2023 | Oil and gas, petrochemical, logistics |

| Kelantan | Kota Bharu industrial areas, Tumpat | Annual monsoon flooding (December-January) | Food processing, timber, agriculture |

| Pahang | Kuantan, Gebeng Industrial Estate | December 2021, annual monsoon | Petrochemical, manufacturing, palm oil |

| Perak | Ipoh industrial areas, Batu Gajah | Periodic flash floods | Manufacturing, construction materials |

Insurers classify flood zones based on historical flood data and proximity to water bodies. If your factory has flooded before, even once, it will be classified as high-risk and your flood premium will be significantly higher. But the cost of being uninsured is always higher than the cost of the premium.

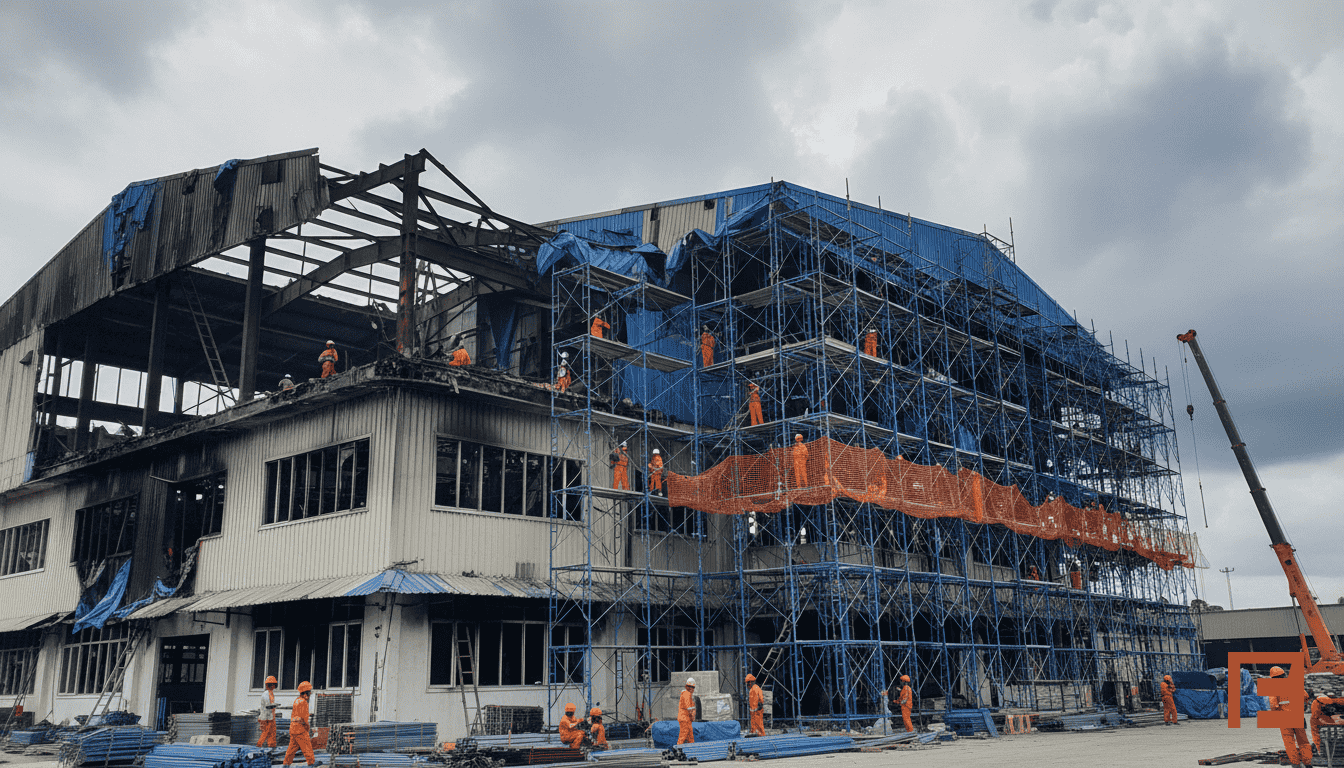

What Flood Damage Looks Like in a Factory

Flood damage to factories goes far beyond wet floors. The real cost comes from multiple categories of loss that accumulate rapidly.

| Category of Loss | Examples | Typical Cost Range | Covered by Fire Insurance? |

|---|---|---|---|

| Building damage | Flooring, walls, electrical wiring, lifts | RM100,000 - RM2,000,000+ | No (flood excluded) |

| Machinery damage | Motors, control panels, bearings, CNC machines | RM500,000 - RM10,000,000+ | No (flood excluded) |

| Raw materials and stock | Raw materials, WIP, finished goods contaminated by flood water | RM200,000 - RM5,000,000+ | No (flood excluded) |

| Business interruption | Lost production, delayed orders, contract penalties | RM300,000 - RM10,000,000+ | No (BI requires material damage trigger) |

| Cleanup and restoration | Mud removal, dehumidification, sanitisation | RM50,000 - RM500,000 | No (flood excluded) |

| Electronic equipment | Servers, SCADA systems, PLCs, sensors | RM100,000 - RM3,000,000+ | No (consider EEI insurance) |

A mid-sized manufacturing factory in Shah Alam with 1 metre of flood water could face total losses of RM5 million to RM20 million across all categories. Without flood coverage, this comes entirely out of the factory owner's pocket.

Common Coverage Gaps That Catch Factory Owners

Even factory owners who have flood coverage often discover gaps during a claim. These gaps exist because of policy structure, not because the insurer is acting in bad faith.

| Coverage Gap | How It Happens | How to Avoid It |

|---|---|---|

| Underinsurance (average clause) | Sum insured is less than actual replacement value. Claim is reduced proportionally. | Update sum insured annually. Account for inflation and new equipment. |

| Flood sub-limit | Policy has a separate lower limit for flood losses (e.g., RM500,000 on a RM20M policy) | Check for sub-limits. Negotiate higher flood limits. |

| Third-party warehouse excluded | Stock stored at third-party warehouses not listed in policy schedule | Declare all storage locations. Add them to policy schedule. |

| BI coverage missing or inadequate | Business interruption coverage not added or indemnity period too short | Add BI extension. Set indemnity period based on worst-case recovery time. |

| High deductible for flood | Flood deductible set at RM100,000+ in high-risk zones | Understand your deductible. Budget for the first-loss amount. |

| Machinery not properly valued | Machinery insured at depreciated value instead of replacement value | Insure on reinstatement (new replacement) basis. |

The Average Clause: How Underinsurance Reduces Your Claim

The average clause is the most common reason for reduced flood claims in Malaysia. If your property is worth RM20 million but you only insure it for RM10 million (50%), your claim will be reduced by 50% regardless of the actual loss amount.

Example: Factory with RM20 million replacement value insured for only RM12 million. Flood causes RM3 million damage. The claim is not paid at RM3 million. Instead, the insurer applies the average clause: RM3 million x (RM12M / RM20M) = RM1.8 million. The factory owner bears RM1.2 million of the loss.

This penalty applies to every claim, not just large ones. The only way to avoid it is to insure for the full replacement value of all insured property.

Flood Mitigation Measures and Insurance Premium Impact

Investing in flood mitigation not only protects your premises but can also reduce your insurance premiums. Insurers recognise physical flood protection measures during underwriting.

| Mitigation Measure | Estimated Cost | Effectiveness | Premium Impact |

|---|---|---|---|

| Elevated storage racks (stock above flood level) | RM5,000 - RM50,000 | Protects stock from shallow flooding | Moderate impact on stock coverage |

| Drainage maintenance and clearing | RM2,000 - RM10,000/year | Prevents drainage blockage flooding | Demonstrates good risk management |

| Temporary flood barriers (sandbags, water-filled barriers) | RM3,000 - RM20,000 | Protection for flash floods with warning time | Minimal direct premium impact |

| Permanent flood walls / bund walls | RM50,000 - RM500,000 | High protection against river flooding | Significant premium reduction possible |

| Sump pumps and automated drainage | RM20,000 - RM100,000 | Rapid water removal during minor floods | Positive underwriting factor |

| Electrical equipment elevated above flood level | RM10,000 - RM100,000 | Protects critical electrical infrastructure | Reduces risk of total electrical loss |

| Flood response plan and training | RM5,000 - RM15,000/year | Faster response reduces damage severity | Demonstrates proactive risk management |

For a comprehensive guide on flood mitigation engineering, refer to our factory flood mitigation guide.

Get a flood coverage assessment →

How to Check If Your Current Policy Covers Flood

Many factory owners do not know whether their policy includes flood coverage. Here is how to check your existing fire insurance policy.

- Check the policy schedule - Look for "Special Perils" or "Extended Perils" listed as an extension. If not listed, flood is not covered.

- Check for sub-limits - Even if special perils is included, there may be a separate sub-limit for flood that is much lower than your main sum insured.

- Check the deductible - Flood deductibles are often higher than standard fire deductibles. Know exactly how much you would need to absorb.

- Check the exclusions - Some policies exclude specific types of water damage (e.g., surface runoff vs river overflow). Understand the definitions.

- Check if BI follows flood - If you have business interruption coverage, confirm whether the BI section also covers losses triggered by flood. BI operates on a material damage trigger, so the flood peril must be covered under the material damage section.

If your policy does not include flood coverage and you are in a flood-prone area, contact your insurance broker immediately. Do not wait for the next monsoon season.

Claims Process After a Flood Event

If your factory is flooded and you have the right coverage, follow these steps to protect your claim.

| Step | Action | Timeframe | Important Notes |

|---|---|---|---|

| 1 | Document the damage immediately (photos, videos, written records) | Within hours of flood receding | Document before any cleanup begins. Show water levels on walls. |

| 2 | Notify your insurance broker and insurer | Within 24-48 hours | Late notification can prejudice your claim. Call, then follow up in writing. |

| 3 | Take reasonable steps to prevent further damage | Immediately | You have a duty to mitigate. Pump out water, protect undamaged items. |

| 4 | Preserve damaged items for loss adjuster inspection | Until loss adjuster inspects | Do NOT dispose of damaged items until the loss adjuster has seen them. |

| 5 | Prepare claim documentation (inventory, invoices, repair quotes) | 1-4 weeks | Better documentation = faster settlement. Include purchase records. |

| 6 | Cooperate with loss adjuster investigation | As scheduled | Loss adjuster is appointed by insurer but should be given full access. |

The biggest mistake after a flood is disposing of damaged stock and machinery before the loss adjuster has inspected them. Once evidence is destroyed, it is extremely difficult to substantiate your claim amount. Keep everything in place and document thoroughly.

Building Your Complete Flood Protection Strategy

The right insurance structure depends on your factory's value, location, and risk profile. Here is a framework for building comprehensive flood protection.

| Factory Profile | Recommended Coverage | Reason |

|---|---|---|

| Small factory, low flood risk, assets under RM5M | Fire Insurance + Special Perils extension | Cost-effective flood coverage for simple operations |

| Medium factory, moderate flood risk, assets RM5M-RM20M | IAR with BI extension | Broader coverage justifies premium; BI protects revenue |

| Large factory, high flood risk, assets RM20M+ | IAR + BI + MB/MLOP + EEI | Multiple policies cover different asset categories and loss types |

| Factory with critical machinery (e.g., semiconductor, automotive) | IAR + MB + MLOP + EEI | Machinery replacement time is months; need MB for physical damage and MLOP for lost profits |

| Factory with high-value stock (e.g., electronics, pharma) | IAR with adequate stock sum insured + BI | Stock values fluctuate; use declaration-linked policy if possible |

There is no one-size-fits-all solution. The right structure depends on your specific risks, budget, and recovery time requirements. A specialist insurance broker can help you design a programme that covers the gaps without paying for unnecessary overlap.

Frequently Asked Questions

Does standard fire insurance in Malaysia cover flood damage?

No. Standard fire insurance in Malaysia covers only three named perils: fire, lightning, and domestic explosion. Flood is excluded. To add flood coverage, you need the Special Perils extension or a switch to an Industrial All Risks (IAR) policy.

How much does flood coverage cost as an add-on to fire insurance?

The cost depends on your flood zone classification. Low-risk areas pay 0.02% to 0.05% of sum insured. High-risk areas pay 0.15% to 0.50% or more. For a RM20M factory in a moderate risk zone, expect RM10,000 to RM30,000 additional annual premium.

What is the difference between fire insurance and IAR for flood coverage?

Fire insurance is a named perils policy where flood requires a separate add-on. IAR is an all-risks policy where flood is generally included by default. With IAR, the burden of proof shifts to the insurer to prove an exclusion applies, giving the policyholder a stronger claims position.

What is the average clause and how does it affect flood claims?

The average clause penalises underinsurance. If your property is worth RM20M but insured for only RM12M (60%), your claim is reduced to 60% of the loss amount. This applies to every claim, not just large ones. The only way to avoid it is to insure for full replacement value.

Can I get flood coverage if my factory has flooded before?

Yes, but at a higher premium and potentially with higher deductibles. Insurers will classify your premises as high-risk. Investing in physical flood mitigation (bund walls, pumps, elevated equipment) can help reduce the premium loading and demonstrate proactive risk management.

What should I do immediately after a flood to protect my insurance claim?

Document all damage with photos and videos before any cleanup begins. Notify your broker and insurer within 24 to 48 hours. Take reasonable steps to prevent further damage. Do not dispose of any damaged items until the loss adjuster has inspected them. Keep all receipts for emergency expenses.

Does business interruption insurance cover flood-related production losses?

Only if two conditions are met: your material damage policy (fire or IAR) must include flood coverage, and your BI extension must be active. BI operates on a material damage trigger. If flood damage is excluded from your material damage section, BI will not respond to flood-related production losses.

Is special perils extension worth the cost for factories in low-risk areas?

Yes. Climate patterns are changing and areas previously considered low-risk have experienced unprecedented flooding. The 2021 Klang Valley floods affected areas that had never flooded before. At 0.02% to 0.05% of sum insured, the cost is minimal compared to the potential loss.

Can I choose only flood coverage without other special perils?

Generally no. Special perils coverage in Malaysia is sold as a package that includes flood, storm, riot, impact, and other perils bundled together. You cannot select individual perils in most standard fire insurance policies.

How do I know if my factory is in a flood zone?

Check with your local PBT (Pihak Berkuasa Tempatan) for flood zone maps. You can also review the Department of Irrigation and Drainage (DID) flood maps. Your insurance broker can help assess your flood risk based on location data and historical claims in the area.

Get your free coverage review today →

Unlock Exclusive Foundation Content

Subscribe for best practices,

research reports, and more, for your industry

Want to contact Foundation for your risk or insurance needs?

Insights on Property & Engineering Risks

Practical guidance on construction, industrial, and engineering insurance in Malaysia

Let’s Work Together

If you're managing a construction project, industrial facility, or commercial property in Malaysia and need insurance coverage, we can help structure a program that works.