Business Interruption Insurance Malaysia: Complete Guide for Factories, Data Centres & Industrial Facilities

Business Interruption Insurance covers lost revenue and ongoing expenses when operations stop due to fire, flood, or equipment failure. This guide explains how Malaysian factories, data centres, cold storage facilities, and logistics operations can protect against downtime losses that average USD 125,000 per hour.

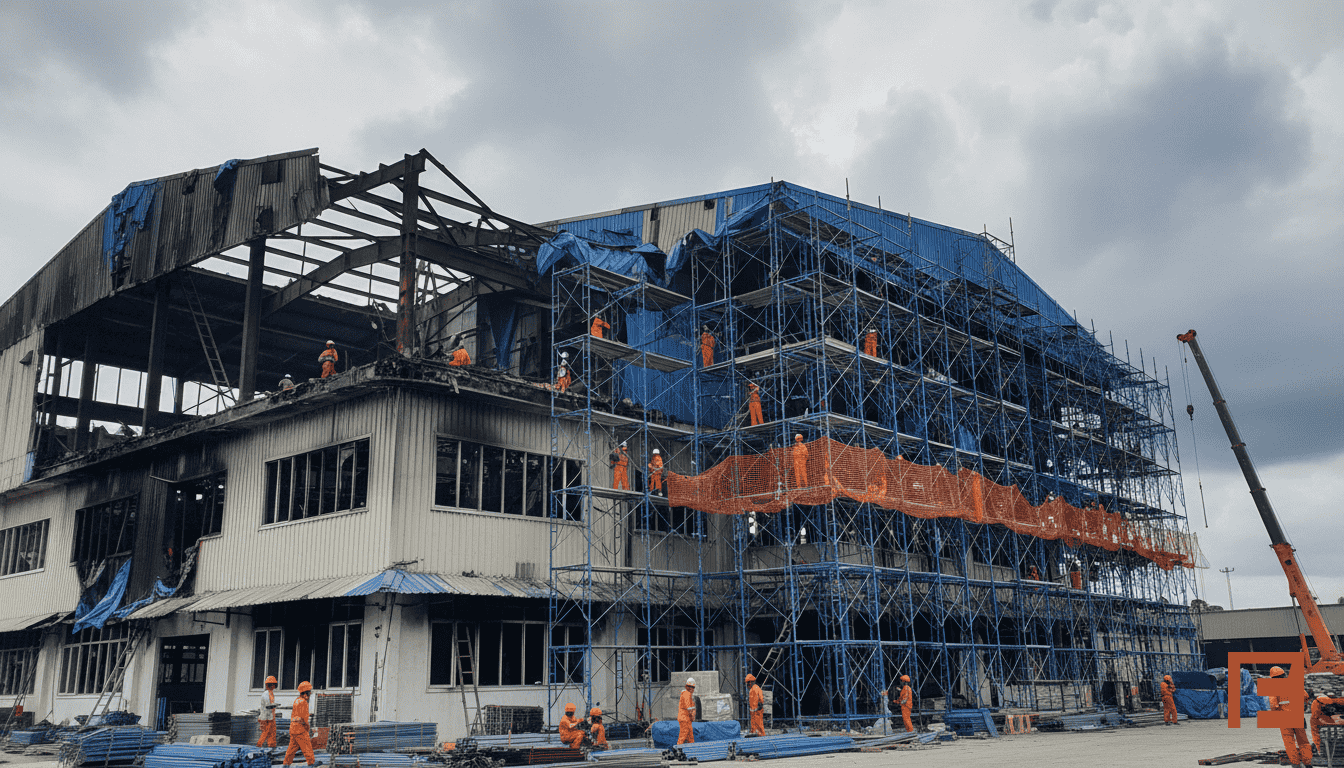

A fire shuts down your factory for six months. Your machinery is insured. Your building is covered. But who pays the RM 2 million in revenue you lose while rebuilding? Who covers employee salaries during the shutdown? Who handles the loan repayments that don't stop just because production did?

Business Interruption Insurance (BI) covers the financial losses your property insurance doesn't: lost revenue, ongoing expenses, and the costs of getting back to normal operations after a covered incident.

This guide covers:

- What Business Interruption Insurance covers and how it works

- Which facilities need BI coverage (factories, data centres, cold storage, warehouses)

- How to calculate the right sum insured and indemnity period

- Common coverage gaps and how to avoid underinsurance

- Claims requirements and documentation

What Is Business Interruption Insurance?

Business Interruption Insurance, also called consequential loss insurance, compensates your business for income lost when operations stop due to an insured event. In Malaysia, BI coverage is typically purchased as an extension to your Fire Insurance or Industrial All Risks (IAR) policy.

The key principle: BI insurance aims to put your business back in the same financial position it would have been in had the incident never occurred. Not just rebuild your building, but restore your profitability.

| Coverage Type | What It Covers | What It Doesn't Cover |

|---|---|---|

| Property Insurance | Physical damage to buildings, machinery, stock | Lost revenue during repairs |

| Business Interruption Insurance | Lost gross profit, ongoing expenses, increased costs of working | Physical damage to property |

The catch: BI insurance only triggers when there's a valid claim under your material damage policy. No property damage claim means no BI claim, even if your business stops operating.

Who Needs Business Interruption Insurance?

Any Malaysian facility where downtime means financial loss should consider BI coverage. The question isn't whether you need it, but how much coverage is adequate for your specific operations.

Manufacturing Facilities

Factories face the classic BI risk profile: high fixed costs that continue regardless of production output. A fire that destroys your production line means you're still paying salaries, loan repayments, and fixed overheads while generating zero revenue.

According to industry research, unplanned downtime costs manufacturing operations an average of USD 125,000 per hour. For automotive manufacturing, that figure exceeds USD 2 million per hour. Malaysian manufacturers in electronics, food processing, and chemicals face similar exposure.

Data Centres and IT Facilities

Data centres operate under extreme uptime requirements, often contractually bound to 99.99% or higher availability. For large data centres, downtime costs average USD 9,000 per minute, or over USD 540,000 per hour. A single 90-minute outage can result in over USD 500,000 in direct losses.

Data centres face unique BI considerations including service level agreement (SLA) penalties to clients, reputational damage affecting future contracts, and the interconnected nature of their operations where one failure can cascade through dependent systems.

Unlock Exclusive Foundation Content

Subscribe for best practices,

research reports, and more, for your industry

Want to contact Foundation for your risk or insurance needs?

Insights on Property & Engineering Risks

Practical guidance on construction, industrial, and engineering insurance in Malaysia

Let’s Work Together

If you're managing a construction project, industrial facility, or commercial property in Malaysia and need insurance coverage, we can help structure a program that works.