SPPI Insurance Malaysia | Single Project PI for Construction

Complete guide to Single Project Professional Indemnity (SPPI) insurance in Malaysia. Covers what SPPI protects, when it's required, how it differs from annual PI, tender and bank requirements, premium factors, and real claim scenarios for contractors, consultants, and engineers. Published Date: 2026-02-08

Disclaimer: This article provides general guidance on insurance coverage available in the Malaysian market. Policy terms, conditions, and availability vary by insurer. Always review your specific policy wording or consult a qualified insurance professional before making coverage decisions.

You've won a RM80M design-and-build contract for a data centre in Johor. The contract requires Professional Indemnity insurance with a minimum limit of RM10M per claim. Your annual PI policy has a RM5M aggregate limit shared across all your projects. One large claim from another project could exhaust your limit before the data centre is even half-built. This is exactly the problem SPPI solves.

This guide explains how Single Project Professional Indemnity (SPPI) works, when you need it instead of (or alongside) annual PI, who requires it in their contracts, how much it costs, and what happens when a design error claim actually lands.

This guide covers:

- What SPPI covers and how it differs from annual PI

- When SPPI is required (tender conditions, bank requirements, contract clauses)

- Who needs SPPI in Malaysia (by profession and project type)

- SPPI policy structure: retroactive date, extended reporting, run-off

- Premium factors and indicative cost ranges

- Real claim scenarios showing how SPPI responds

- How SPPI fits with CAR, EAR, and other project insurance

What Does SPPI Cover?

Single Project Professional Indemnity insurance covers claims arising from professional negligence, errors, or omissions in the design, supervision, or project management of a specific named construction or engineering project. It protects the insured against financial loss caused by their professional services on that one project.

SPPI covers:

- Design errors: Structural calculation mistakes, incorrect material specifications, flawed MEP design

- Supervision failures: Failure to identify defective workmanship during site supervision

- Project management negligence: Cost overruns or delays caused by professional error in project management

- Breach of professional duty: Failure to exercise reasonable skill, care, and diligence

What SPPI Does NOT Cover

| Not Covered | Why | What Covers This Instead |

|---|---|---|

| Physical damage to the construction works | This is property damage, not professional liability | CAR / EAR insurance |

| Third-party bodily injury on site | This is general liability, not professional negligence | CGL insurance |

| Worker injuries | Covered by workers' compensation framework | WC / SOCSO |

| Deliberate or fraudulent acts | Insurance covers negligence, not intentional wrongdoing | Nothing (uninsurable) |

| Contractual penalties not arising from negligence | Liquidated damages for delay (without underlying professional error) | DSU (Delay in Start-Up) if construction insurance includes it |

| Work on other projects | SPPI is project-specific; other projects need separate cover | Annual PI policy for all other projects |

SPPI vs Annual PI: When to Use Which

This is the fundamental question every contractor, consultant, and engineer faces. Annual PI covers all your professional work for the policy year. SPPI covers one specific project. They serve different purposes and are often used together.

| Feature | Annual PI | SPPI |

|---|---|---|

| Scope | All professional work during the policy year | One named project only |

| Limit | Aggregate limit shared across all projects | Dedicated limit for that project |

| Duration | 12 months (must renew annually) | Project duration + run-off period (often 6-12 years total) |

| Renewal risk | Must renew every year; insurer can decline renewal or increase premium | No renewal needed; coverage extends through run-off automatically |

| Claims from other projects | Can erode limit available for the project you care about | Dedicated limit; other project claims don't affect it |

| Run-off cover | Ends when you stop renewing (or close the firm) | Built-in run-off period protects against latent defect claims |

| Cost basis | Based on annual fee income | Based on project value, professional fees, and project duration |

| Best for | Firms with multiple ongoing projects of similar size | Large or high-profile projects where a dedicated limit is needed |

When SPPI Is the Better Choice

SPPI is the right answer when any of these conditions apply:

- The project contract requires it. Many large contracts (especially government, CIDB G7, and international projects) specifically require SPPI with a dedicated limit.

- The required PI limit exceeds your annual policy aggregate. If a project requires RM10M PI cover but your annual policy has RM5M aggregate, SPPI provides the additional dedicated capacity.

- You need run-off protection. Professional negligence claims can surface years after project completion. SPPI with a 6-year run-off provides certainty that annual PI (which requires continuous renewal) can't match.

- The project is disproportionately large relative to your other work. If one project represents 50%+ of your annual revenue, a claim from that project could exhaust your annual PI limit, leaving your other projects exposed.

- The client is a bank or institutional lender. Banks financing construction projects often require SPPI as a condition of drawdown because they need certainty that the PI limit is dedicated to their project.

Need SPPI for an upcoming tender? Talk to Foundation

Who Requires SPPI in Malaysia?

SPPI requirements come from three main sources: contract conditions, professional regulatory bodies, and financing institutions.

| Source of Requirement | Typical Requirement | Typical Limit |

|---|---|---|

| Government contracts (JKR, JPS, other ministries) | PI coverage as tender condition; SPPI for larger projects | RM1M-10M (depends on project size) |

| Private sector (developers, corporates) | PI cover specified in consultancy agreements | Typically 2-3x professional fees or percentage of contract value |

| Banks and financial institutions | SPPI as condition precedent to loan drawdown for construction financing | Varies; often tied to loan amount or project cost |

| Board of Engineers Malaysia (BEM) | PI cover required for practising engineers | Annual PI; BEM doesn't specify SPPI but contract may |

| Lembaga Arkitek Malaysia (LAM) | PI cover required for practising architects | Annual PI; LAM doesn't specify SPPI but contract may |

| International projects / foreign clients | SPPI with specific run-off requirements (often 6 years) | RM5M-50M+ (international project standards) |

Who Needs SPPI (By Profession)

| Profession | Professional Services Covered | Common Claim Triggers |

|---|---|---|

| Consulting Engineers (civil, structural, MEP) | Structural design, foundation design, MEP engineering, geotechnical | Structural failure, inadequate foundation design, MEP system underperformance |

| Architects | Architectural design, specification, contract administration | Design deficiency, specification errors, inadequate supervision |

| Quantity Surveyors | Cost estimation, bill of quantities, contract valuation | Cost underestimation, measurement errors, valuation disputes |

| Project Managers / PMC | Project planning, coordination, schedule management, cost control | Schedule delays, cost overruns, coordination failures between trades |

| Design-and-Build Contractors | Integrated design and construction; design portion of D&B contract | Design defects discovered during or after construction |

| Specialist Subcontractors (design element) | Design of specialised systems: piling, ACMV, fire protection, lifts | System design failure, performance shortfall |

SPPI Policy Structure: Key Terms

Understanding SPPI policy structure is important because it works differently from most insurance policies. SPPI is a claims-made policy, not an occurrence policy. This distinction matters.

| Term | What It Means | Why It Matters |

|---|---|---|

| Claims-made basis | The policy responds when a claim is first made (or notified), not when the negligent act occurred | You must have active cover when the claim arrives, even if the error happened years earlier |

| Retroactive date | The earliest date from which professional services are covered (usually project inception date) | Work done before the retroactive date isn't covered even if the claim comes during the policy period |

| Policy period | From project start to practical completion (or defects liability period end) | Active coverage during construction when most errors are discovered |

| Extended reporting period (run-off) | Period after project completion during which claims can still be made (typically 3-6 years) | Professional negligence claims often surface years after completion (latent defects, structural issues) |

| Limit of indemnity | Maximum amount the insurer pays per claim and/or in aggregate | Dedicated to this project; not shared with other projects (unlike annual PI) |

| Defence costs | Legal costs to defend the claim; may be within or in addition to the limit | "Defence costs in addition" is better; "inclusive" means legal fees eat into your indemnity limit |

Why Run-Off Protection Matters

Construction defects don't always appear during construction. A structural design error might only manifest 5 years after the building is occupied, when cracks appear in the foundations. An MEP design shortfall might only become apparent when the building is fully loaded and the cooling system can't maintain temperature.

With annual PI, you need to keep renewing your policy for years after project completion to maintain coverage. If your firm closes, merges, or the insurer declines renewal, you lose coverage for historical projects. SPPI with built-in run-off (typically 6 years from practical completion) provides certainty. The coverage is paid for upfront and can't be cancelled.

This is particularly important for consultants approaching retirement. If you close your practice, your annual PI coverage stops. Any claims from past projects become your personal financial liability. SPPI with run-off protection survives the closure of your practice.

SPPI Premium Factors

| Factor | What Underwriters Assess | Impact on Premium |

|---|---|---|

| Project value | Total construction cost of the project | High: larger projects = higher potential claim values |

| Professional fees | Value of professional services being provided | High: higher fees = more services = more exposure |

| Scope of services | Design only, design + supervision, full D&B, project management | High: D&B (design responsibility) = higher rate than supervision only |

| Project type | Building, infrastructure, industrial, oil and gas | Medium-High: complex projects (bridges, tunnels, industrial) = higher rates |

| Limit of indemnity | Amount of cover required (per claim and aggregate) | High: higher limits = higher premium (not linear; diminishing increase) |

| Run-off period | Length of post-completion coverage (3 years, 6 years, longer) | Medium: longer run-off = higher premium (but critical protection) |

| Firm's track record | Claims history, years in practice, qualifications, similar project experience | Medium: experienced firms with clean records get better terms |

| Project duration | Construction period (months/years) | Medium: longer projects = longer exposure period |

Indicative SPPI Premium Ranges

| Project Value | Typical PI Limit | Indicative SPPI Premium | Run-Off Included |

|---|---|---|---|

| RM10M-30M | RM1M-3M | RM8,000-25,000 | 3-6 years |

| RM30M-100M | RM3M-10M | RM20,000-60,000 | 3-6 years |

| RM100M-500M | RM5M-20M | RM50,000-150,000 | 6 years |

| RM500M+ | RM10M-50M+ | RM100,000-500,000+ | 6 years |

SPPI premium is a one-time cost for the entire project duration plus run-off, not an annual payment. This is a significant advantage: you pay once and have certainty of coverage for 6-12 years, compared to annual PI where you pay every year and face renewal uncertainty.

Claim Scenarios: When Design Errors Surface

Scenario 1: Foundation Design Error on Industrial Building

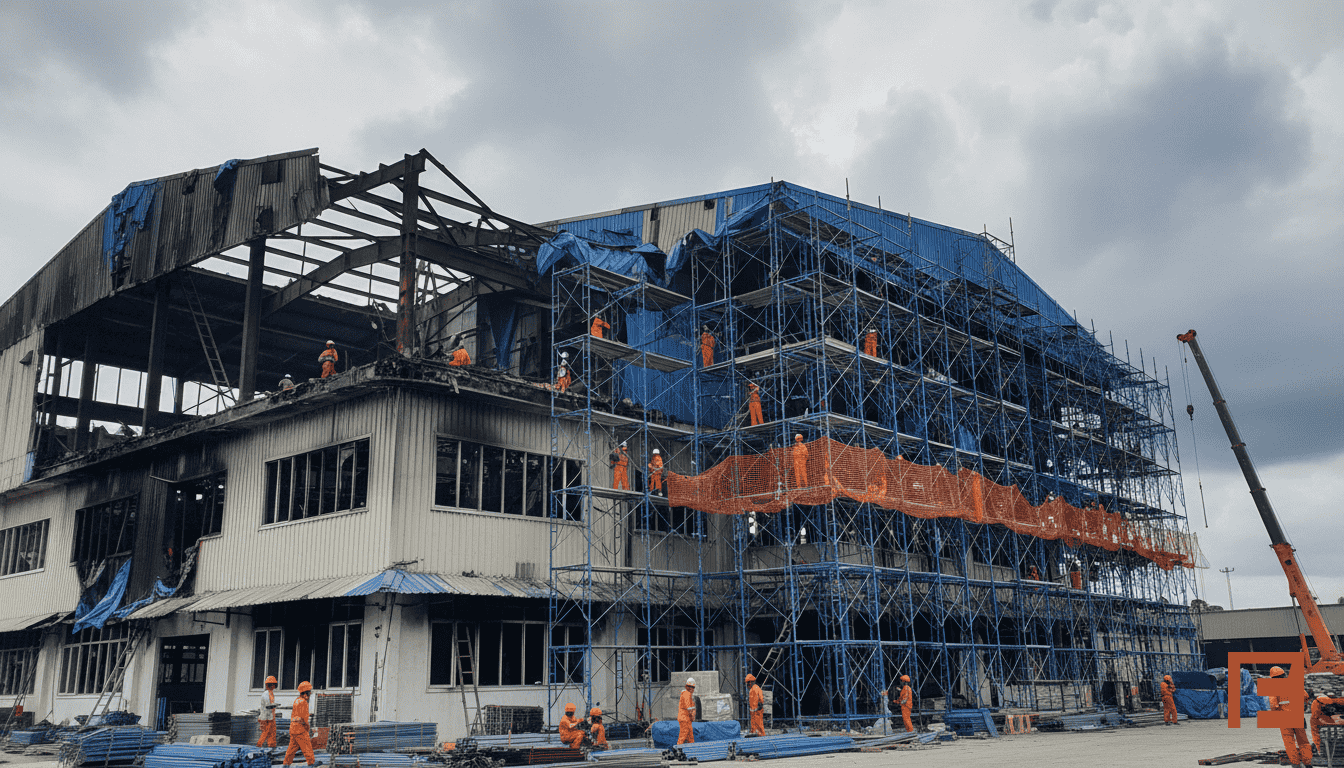

A consulting engineer designs the pile foundations for a RM45M factory building in an industrial estate. The geotechnical investigation was conducted at only 3 boreholes instead of the 6 recommended for the site size. The piling design is based on soil data that misses a layer of soft clay on the eastern portion of the site. After construction, the eastern wing settles 80mm differentially, causing structural cracking.

| Claim Component | Estimated Cost | Covered by SPPI? |

|---|---|---|

| Underpinning and remedial piling works | RM3.2M | Yes (cost to rectify the consequence of design error) |

| Structural repairs (crack injection, column reinforcement) | RM800K | Yes |

| Additional geotechnical investigation | RM150K | Yes |

| Factory owner's loss of use during remedial works (3 months) | RM2M | Depends on policy wording (consequential loss) |

| Legal and expert witness costs | RM400K | Yes (defence costs) |

| Total claim | RM6.55M |

The lesson: The engineer's professional fees for the project were RM300K. The claim is RM6.55M. Without SPPI (or adequate annual PI), the engineer's firm faces a claim 22x their professional fees. This is the kind of disproportionate exposure that PI insurance exists to cover.

Scenario 2: MEP Design Shortfall in Data Centre

A consulting firm designs the mechanical and electrical systems for a RM200M data centre in Johor. The cooling system design is based on a maximum IT load of 15MW. The client's actual deployment reaches 18MW within 2 years of operation. The cooling system cannot maintain the required temperature at full load, causing repeated thermal shutdowns.

| Claim Component | Estimated Cost | Covered by SPPI? |

|---|---|---|

| Supplementary cooling system installation | RM8M | Yes (cost to remedy the design shortfall) |

| Electrical infrastructure upgrade for additional cooling | RM3M | Yes |

| Revenue lost during thermal shutdowns | RM5M | Depends on policy wording |

| SLA penalties paid to tenants | RM2M | Depends on policy wording |

| Total claim | RM18M |

The lesson: This claim surfaced 2 years after practical completion. With annual PI, the consultant would need to have maintained continuous coverage. With SPPI including 6-year run-off, the claim falls squarely within the coverage period. The dedicated RM20M limit means the full claim is covered without being eroded by claims from the firm's other projects.

Scenario 3: Contractor's D&B Design Defect

A design-and-build contractor wins a RM60M factory construction project. The contractor's in-house design team specifies a steel roof truss system. During the first monsoon season after completion, the roof deflects excessively under ponding rainwater loads that weren't adequately accounted for in the design. Several roof panels detach, allowing water ingress that damages machinery below.

| Claim Component | Estimated Cost | Covered by SPPI? |

|---|---|---|

| Roof truss reinforcement and panel replacement | RM1.8M | Yes |

| Machinery damage from water ingress | RM500K | Yes (consequential damage from design defect) |

| Temporary weatherproofing during repairs | RM200K | Yes (mitigation costs) |

| Total claim | RM2.5M |

The lesson: This is a D&B contractor claim, not a consultant claim. The CAR policy expired at practical completion. The defects liability period insurance (if purchased) may cover workmanship defects but not design defects. Only SPPI covers the design error that caused the roof failure. D&B contractors need SPPI because they carry design responsibility.

How SPPI Fits with Project Insurance

On a major construction project, SPPI is one part of a coordinated insurance programme. Here's how all the pieces fit together.

| Policy | What It Covers on the Project | Typically Arranged By |

|---|---|---|

| CAR / EAR | Physical damage to the works during construction | Contractor (or employer for larger projects) |

| DSU (Delay in Start-Up) | Lost revenue from project delays caused by insured construction damage | Employer / Developer |

| SPPI | Design errors, professional negligence by consultants/D&B contractors | Consultant, D&B contractor, or employer (project-wide) |

| CGL | Third-party bodily injury and property damage from construction activities | Contractor |

| WC | Worker injuries on construction site | Contractor |

CAR covers the physical works. SPPI covers the professional design. CGL covers third-party liability. WC covers worker injuries. Each addresses a different risk. Removing any one creates a gap that the others don't fill.

Need a coordinated project insurance programme? Talk to Foundation

FAQ

Can I rely on my annual PI instead of buying SPPI?

You can, but it's risky for large projects. Annual PI has an aggregate limit shared across all your projects. One large claim from another project can exhaust your limit before the project you care about makes a claim. Annual PI also requires continuous renewal; if the insurer declines renewal or you close your firm, coverage stops. SPPI provides a dedicated limit and built-in run-off that annual PI can't match.

Does the main contractor's CAR policy cover design defects?

CAR Section I covers physical damage to the works from design defects (the cost to rectify the defective part is excluded, but damage caused by the defect to other parts is covered). But CAR doesn't cover the professional negligence claim from the employer seeking damages for the design error itself. SPPI covers the professional liability; CAR covers the physical damage. They're complementary, not alternatives.

How much run-off do I need?

The standard recommendation is 6 years from practical completion, which aligns with the limitation period for claims in contract under Malaysian law. Some contracts (especially international ones) require longer run-off. For buildings, consider that structural defects can take years to manifest. Foundation recommends 6 years as the minimum; 12 years for infrastructure projects with longer design lives.

Who pays for SPPI on a project?

It depends on the contract structure. On consultant-led projects, the consultant typically buys their own SPPI (or relies on annual PI). On D&B projects, the D&B contractor typically provides SPPI as a contract requirement. On very large projects, the employer/developer may purchase a project-wide SPPI that covers all design professionals on the project under a single policy.

Is SPPI required for CIDB G7 contractors?

CIDB requirements specify insurance obligations that vary by grade and project type. While CIDB doesn't specifically mandate SPPI, many government contract conditions for large projects require PI cover for design elements. For G7 contractors doing D&B work, SPPI is often a practical necessity even when not explicitly named because the contract requires PI cover that annual policies may not adequately provide.

What's the deductible on SPPI?

SPPI deductibles typically range from RM10,000-100,000 depending on the project size and limit of indemnity. Higher deductibles reduce the premium. The deductible applies per claim, meaning you pay the first RM10-100K of each claim out of pocket. For firms with strong claims records, accepting a higher deductible can make SPPI significantly more affordable.

Does SPPI cover cost overruns?

Only if the cost overrun results from professional negligence. If a quantity surveyor's bill of quantities contains material errors leading to a RM5M cost overrun, that's a covered claim. But cost overruns from market price increases, scope changes, or unforeseen site conditions are not design errors and therefore not covered by SPPI.

Can multiple consultants be covered under one SPPI policy?

Yes. A project-wide SPPI (sometimes called "Owner Controlled SPPI") covers all named consultants on the project under a single policy. This is common on large projects where the developer wants certainty that all design professionals have adequate PI cover. It also prevents gaps where one consultant has PI and another doesn't.

What happens if I don't notify a potential claim during the policy period?

Late notification can jeopardize your coverage. SPPI is claims-made: the policy responds when you first become aware of a circumstance that might give rise to a claim AND notify the insurer during the policy period (or run-off). If you become aware of a potential issue but don't notify until after the policy expires, the insurer may deny the claim. Always notify early, even if you're not sure it will become a formal claim.

Does Foundation arrange SPPI for data centre projects?

Yes. Data centre projects represent a growing segment of Foundation's SPPI placements. Data centres have particularly high SPPI exposure because the MEP design is complex, the performance requirements are stringent (cooling, power, redundancy), and the consequences of design shortfalls are severe (SLA penalties, thermal shutdowns). Foundation structures SPPI alongside CAR/EAR and DSU as a coordinated construction insurance programme.

Foundation Conclusion

Single Project Professional Indemnity provides certainty that annual PI can't match: a dedicated limit for your most important project, built-in run-off protection that survives firm closure, and no risk of other projects eroding your coverage. For any project where a design error could generate a claim exceeding your annual PI aggregate, or where the contract specifically requires project-specific PI, SPPI is the right answer.

Foundation arranges SPPI alongside CAR, EAR, DSU, CGL, and WC as part of coordinated construction insurance programmes for Malaysian projects.

Talk to Foundation about SPPI for your next project

Disclaimer: This article provides general guidance on insurance coverage available in the Malaysian market. Policy terms, conditions, and availability vary by insurer. Always review your specific policy wording or consult a qualified insurance professional before making coverage decisions.

Unlock Exclusive Foundation Content

Subscribe for best practices,

research reports, and more, for your industry

Want to contact Foundation for your risk or insurance needs?

Insights on Property & Engineering Risks

Practical guidance on construction, industrial, and engineering insurance in Malaysia

Let’s Work Together

If you're managing a construction project, industrial facility, or commercial property in Malaysia and need insurance coverage, we can help structure a program that works.