Machinery Breakdown vs Fire Insurance Malaysia | Factory Guide

Fire Insurance and Machinery Breakdown cover completely different causes of loss. Fire covers external perils. MB covers internal equipment failure. This guide explains why factories need both and how they work together. Meta Title: Machinery Breakdown vs Fire Insurance Malaysia | Factory Guide Meta Description: Fire Insurance covers fire damage to machinery. Machinery Breakdown covers internal failure. Why Malaysian factories need both, how they integrate, and what each costs. Published Date: 2026-02-07

Your factory has fire insurance. Your RM3 million injection moulding machine suffers an electrical burnout and seizes completely. You file a claim. The insurer rejects it because internal electrical failure isn't a fire, lightning, or any other named peril.

Fire Insurance and Machinery Breakdown Insurance cover completely different causes of loss with zero overlap. This guide explains what each policy covers, how they work together, and why Malaysian factories that rely on machinery need both.

This guide covers:

- What Fire Insurance covers vs what Machinery Breakdown covers

- The coverage gap that leaves your equipment exposed

- How loss-of-profits policies differ (BI vs MLOP)

- Premium costs and what drives them

- Three claim scenarios showing why you need both

- How to structure Fire/IAR and MB as an integrated programme

The Core Difference: External Perils vs Internal Failure

Fire Insurance (and its broader cousin, IAR) covers damage to your machinery from external causes: fire, lightning, explosion, flood, impact, theft. The damage comes from outside the machine.

Machinery Breakdown (MB) Insurance covers damage from internal causes: electrical burnout, mechanical failure, material fatigue, centrifugal force, bearing seizure. The damage originates inside the machine itself.

These are mutually exclusive categories. Fire Insurance specifically excludes internal machinery failure. MB specifically excludes fire and external perils. There is no overlap, and there is no single policy that covers both.

| Cause of Loss | Fire Insurance / IAR | Machinery Breakdown (MB) |

|---|---|---|

| Fire damages machinery | Covered | Excluded (external peril) |

| Lightning strike fries control panel | Covered | Excluded (external peril) |

| Flood submerges factory floor | Covered (with extension) | Excluded (external peril) |

| Motor burns out from insulation failure | Excluded (internal failure) | Covered |

| Bearing seizes due to lubrication failure | Excluded (internal failure) | Covered |

| Gearbox teeth strip from material fatigue | Excluded (internal failure) | Covered |

| Centrifugal force tears apart rotating part | Excluded (internal failure) | Covered |

| Voltage surge from internal wiring fault | Excluded (internal failure) | Covered |

| Operator error causes machinery crash | IAR: Covered / Fire: Excluded | Covered (human error) |

| Forklift impacts CNC machine | IAR: Covered / Fire: Excluded | Excluded (external impact) |

The last two rows show why IAR is preferred over basic Fire Insurance for factories: IAR covers accidental damage (forklift impact, operator error) that Fire Insurance rejects. But even IAR doesn't cover internal machinery failure. You still need MB.

What Machinery Breakdown Insurance Covers

MB is an engineering insurance policy that covers sudden and unforeseen physical damage to machinery from internal causes. The key phrase is "sudden and unforeseen," which means gradual deterioration, wear and tear, and known pre-existing defects are excluded.

| Covered Cause | Example | What MB Pays For |

|---|---|---|

| Electrical burnout | Motor winding insulation failure causes short circuit | Motor rewinding or replacement cost |

| Mechanical breakdown | Gearbox teeth fracture from metal fatigue | Gearbox repair or replacement |

| Centrifugal force | Centrifuge rotor disintegrates at operating speed | Rotor replacement and collateral damage to housing |

| Material defect | Casting flaw in turbine blade causes catastrophic failure | Turbine repair, consequential damage to adjacent parts |

| Lack of lubrication | Oil pump failure causes bearing seizure in compressor | Bearing replacement and shaft repair |

| Operator negligence | Wrong material loaded into CNC machine, damages tooling and spindle | Tooling and spindle repair/replacement |

| Water hammer | Steam condensate causes pressure shock in piping system | Pipe and valve replacement |

What MB Does Not Cover

| Exclusion | Reason | Covered By |

|---|---|---|

| Fire damage | External peril, covered by property policy | Fire Insurance / IAR |

| Flood, storm, natural disaster | External peril | Fire Insurance (with extensions) / IAR |

| Theft | External peril | IAR / Burglary policy |

| Wear and tear / gradual deterioration | Not sudden and unforeseen | Maintenance programmes (not insurable) |

| Pre-existing defects known to insured | Not unforeseen | Warranty claims |

| Aesthetic damage (scratches, dents) without functional impact | No physical breakdown occurred | Not insurable |

| Boiler/pressure vessel explosion from own pressure | Separate engineering risk category | BPV Insurance |

The exclusion structure makes the relationship clear: MB fills the gap that Fire/IAR leaves open, and Fire/IAR fills the gap that MB leaves open. They're designed to work as a pair.

Loss-of-Profits: BI vs MLOP

When machinery damage stops your production, the revenue loss often exceeds the repair cost. Both Fire/IAR and MB have loss-of-profits extensions, but they cover different triggers.

| Feature | BI (Business Interruption) | MLOP (Machinery Loss of Profits) |

|---|---|---|

| Attached to | Fire Insurance (as FCL) or IAR (Section B) | Machinery Breakdown Insurance |

| Triggers | Fire, flood, explosion, theft, accidental damage (external perils) | Internal machinery failure (electrical, mechanical, operator error) |

| Covers | Lost gross profit + increased cost of working | Lost gross profit + increased cost of working |

| Typical indemnity period | 12-24 months | 6-12 months (shorter because machinery repair is typically faster) |

| Time deductible | Varies (often 48-72 hours) | Typically 7-14 days |

| Sum insured basis | Annual gross profit x indemnity period | Annual gross profit x indemnity period |

The catch: If your compressor motor burns out (internal failure) and shuts down production for 6 weeks, BI won't pay because the trigger (internal mechanical failure) is excluded from Fire/IAR. Only MLOP covers this loss. And if fire destroys your compressor, MLOP won't pay because fire is excluded from MB. Only BI covers that.

You need both. There's no single loss-of-profits policy that covers all causes of production stoppage.

Premium Comparison: Fire/IAR vs Machinery Breakdown

MB premiums are calculated differently from Fire/IAR. Fire/IAR is rated as a percentage of total insured values. MB is rated based on the types of machinery, their age, condition, and replacement values.

| Policy | Premium Basis | Typical Rate Range | Example: RM30M Machinery |

|---|---|---|---|

| Fire Insurance (machinery only) | % of machinery insured value | 0.05% to 0.15% | RM15,000 to RM45,000 |

| IAR (total policy, not machinery only) | % of total sum insured | 0.08% to 0.18% | Included in overall IAR premium |

| Machinery Breakdown (MB) | Per-machine or schedule-based rate | 0.10% to 0.35% | RM30,000 to RM105,000 |

| MLOP (attached to MB) | % of gross profit sum insured | 0.08% to 0.25% | Depends on gross profit value |

MB Premium Factors

| Factor | Impact on MB Premium |

|---|---|

| Machinery type | Rotating equipment (turbines, compressors) = higher rates than static equipment (tanks, vessels) |

| Age and condition | Equipment over 15-20 years old faces higher rates or coverage restrictions |

| Maintenance programme | Documented preventive maintenance schedule reduces premiums 5-15% |

| Operating environment | Dusty, humid, corrosive environments increase rates |

| Spare parts availability | Imported specialised equipment with long lead times = higher exposure |

| Claims history | Repeat claims on specific machines can result in exclusions or loadings |

| Deductible level | Higher deductibles reduce premiums 5-20% |

A factory with well-maintained modern equipment in a clean operating environment will pay significantly less for MB than one running aging machinery in a harsh environment with no documented maintenance schedule.

Get a combined Fire/IAR and MB premium quotation

Three Claim Scenarios: Why You Need Both

Scenario 1: Compressor Motor Burnout (Plastics Factory)

A 500HP compressor motor in a plastics injection moulding plant suffers winding insulation failure. The motor overheats and burns out. Replacement motor costs RM350,000 including installation. The affected production line is down for 3 weeks, causing RM600,000 in lost gross profit.

| Loss Component | Amount | Fire/IAR Response | MB + MLOP Response |

|---|---|---|---|

| Motor replacement | RM350,000 | Rejected: internal failure | Covered (MB) |

| Lost gross profit (3 weeks) | RM600,000 | Rejected: trigger not a fire/IAR peril | Covered (MLOP, after time deductible) |

| Total loss | RM950,000 | RM0 recovery | Up to RM950,000 recovery |

Without MB and MLOP, the entire RM950,000 falls on the factory owner despite having fire or IAR coverage. This is the most common gap in Malaysian factory insurance programmes.

Scenario 2: Fire in Warehouse Destroys Adjacent Machinery (F&B Factory)

A fire starts in the raw material warehouse of a food processing plant. The fire spreads to the adjacent processing hall and destroys packaging machinery (RM2M) and a freezer compressor system (RM1.5M). Production stops for 2 months. Lost gross profit is RM4M.

| Loss Component | Amount | Fire/IAR Response | MB + MLOP Response |

|---|---|---|---|

| Packaging machinery | RM2,000,000 | Covered (fire damage) | Excluded (external peril) |

| Freezer compressor system | RM1,500,000 | Covered (fire damage) | Excluded (external peril) |

| Lost gross profit (2 months) | RM4,000,000 | Covered (BI/FCL) | Excluded (fire trigger) |

| Total loss | RM7,500,000 | RM7,500,000 recovery | RM0 recovery |

This is the mirror image of Scenario 1. Fire damage to machinery is covered by Fire/IAR, not MB. MB contributes nothing here because the cause of loss (fire) is external.

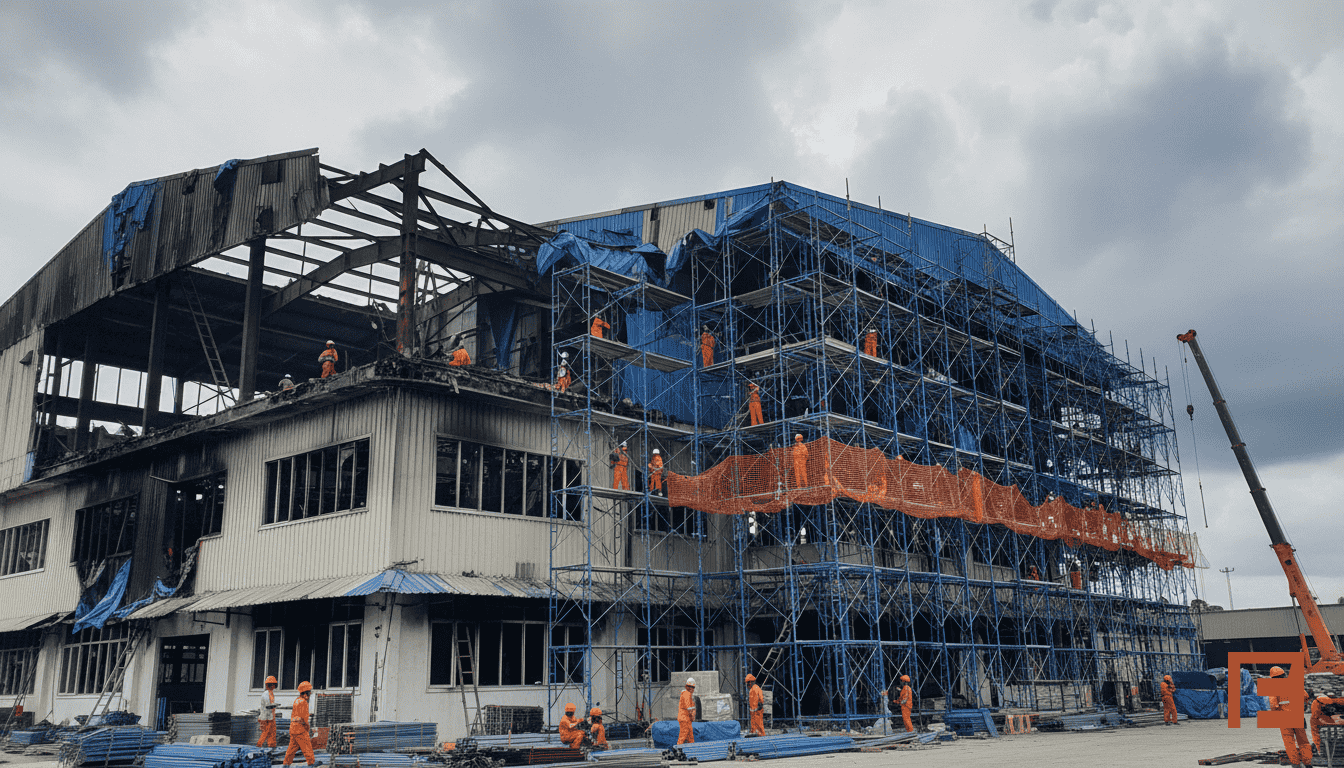

Scenario 3: Gearbox Failure Triggers Secondary Fire (Auto Parts Factory)

A gearbox in a stamping press fails catastrophically. Metal fragments puncture a hydraulic line. Hydraulic oil sprays onto hot surfaces and ignites. The fire damages the stamping press (RM1.5M) plus two adjacent machines (RM3M combined). Gearbox repair cost is RM200K. Total production loss over 6 weeks is RM2.5M.

| Loss Component | Amount | Fire/IAR Response | MB + MLOP Response |

|---|---|---|---|

| Gearbox repair (original failure) | RM200,000 | Excluded (internal failure) | Covered (MB) |

| Fire damage to stamping press | RM1,500,000 | Covered (fire damage) | Excluded (fire damage) |

| Fire damage to adjacent machines | RM3,000,000 | Covered (fire damage) | Excluded (fire damage) |

| Lost gross profit (6 weeks) | RM2,500,000 | Covered (BI: fire trigger) | Covered (MLOP: MB trigger for gearbox failure) |

| Total loss | RM7,200,000 | RM7,000,000 | RM200,000 + MLOP portion |

This scenario shows a chain-reaction loss. The initial cause is internal (gearbox failure = MB), but it triggers a secondary fire (= Fire/IAR). Both policies respond to different components. The gearbox itself is MB. The fire damage to all machines is Fire/IAR. The production loss could be claimed under either BI or MLOP depending on the proximate cause analysis. Having both policies ensures full recovery regardless of how the loss adjuster classifies the chain of causation.

Structuring Fire/IAR and MB as an Integrated Programme

The best approach isn't to buy Fire Insurance and MB as separate standalone policies. It's to structure them as an integrated property and engineering (P&E) programme where each policy's coverage boundary connects cleanly with the next.

| Programme Layer | Policy | Covers | Loss-of-Profits |

|---|---|---|---|

| Property foundation | Fire Insurance + extensions or IAR | Building, machinery, stock from external perils | BI (FCL or IAR Section B) |

| Machinery layer | Machinery Breakdown | Machinery from internal failure | MLOP |

| Pressure vessel layer | BPV | Boilers and pressure vessels from internal pressure | BOLOP |

| Electronic equipment layer | EEI | Electronic equipment from internal defects, voltage issues | ILOP |

Key Integration Principles

Match sum insured bases. Your machinery should be insured at the same value (reinstatement/replacement new) under both Fire/IAR and MB. If Fire/IAR insures your machinery at RM30M but MB only covers RM20M, you have a RM10M gap for internal failure.

Align indemnity periods. If your BI policy has a 12-month indemnity period but your MLOP only has 6 months, you're covered for 12 months of fire-related downtime but only 6 months of MB-related downtime. For factories where machinery failure can take longer to resolve (imported equipment, long lead times), MLOP should match or approach the BI indemnity period.

Coordinate deductibles. A RM50,000 deductible on MB is reasonable if individual machine values are high. But if your most common breakdown involves RM30,000 motor replacements, a RM50,000 deductible means those claims are always out of pocket.

Which Equipment Goes on MB vs Fire/IAR?

Not everything in your factory belongs on the MB schedule. Only machinery and equipment that can suffer internal failure should be listed.

| Equipment Type | Fire/IAR | MB | Notes |

|---|---|---|---|

| Production machinery (CNC, presses, extruders) | Yes (external perils) | Yes (internal failure) | Both policies needed |

| Compressors and pumps | Yes | Yes | Both policies needed |

| Transformers and switchgear | Yes | Yes (or EEI) | EEI may be more appropriate for electronic equipment |

| Boilers and pressure vessels | Yes (fire/explosion damage) | No (use BPV) | BPV covers internal pressure failure |

| Building (structure, walls, roof) | Yes | No | Not machinery |

| Stock and raw materials | Yes | No | Not machinery |

| Office furniture and fittings | Yes | No | Not machinery |

| Forklifts and material handling | Yes (IAR covers impact) | Yes (engine/transmission failure) | Both policies needed for mobile plant |

FAQ

Why doesn't Fire Insurance cover machinery breakdown?

Fire Insurance is a property policy covering external perils (fire, flood, impact). Internal machinery failure is an engineering risk requiring specialised engineering insurance. The separation exists because the risk assessment, underwriting, and claims expertise for machinery failure is fundamentally different from property damage assessment.

Can I add machinery breakdown to my IAR policy?

Standard IAR doesn't include MB coverage. Under the LSR scheme (above RM300M total sum insured), some bespoke IAR wordings can integrate machinery breakdown cover. For standard tariff IAR, MB remains a separate policy. But IAR and MB are designed to sit together: IAR handles external perils, MB handles internal failure.

Is Machinery Breakdown Insurance mandatory in Malaysia?

MB is not legally mandatory. But if your factory relies on specific machinery for production, operating without MB means absorbing the full cost of any internal equipment failure. For factories where a single machine failure can halt production for weeks, MB isn't optional in practical terms.

What's the difference between MB and EEI?

MB covers mechanical and electrical machinery (motors, compressors, gearboxes, turbines). EEI covers electronic equipment (PLCs, servers, control systems, data processing equipment). EEI also covers perils that MB doesn't, like voltage surges and atmospheric humidity damage to sensitive electronics. If you have both traditional machinery and electronic control systems, you may need both MB and EEI.

Does MB cover the full replacement cost of old machinery?

MB policies typically pay on a reinstatement basis (replacement new) or indemnity basis (current value less depreciation), depending on the policy terms. Reinstatement basis pays the cost of a new replacement machine. Indemnity basis deducts depreciation based on age. Always confirm your basis of settlement before buying the policy.

How is MLOP different from BI?

MLOP (Machinery Loss of Profits) covers lost revenue when machinery breakdown (internal failure) stops production. BI (Business Interruption) covers lost revenue when fire, flood, or other external perils stop production. They cover the same financial loss but are triggered by different causes. If your compressor burns out internally, MLOP pays. If fire destroys it, BI pays.

What's a typical MLOP time deductible?

MLOP policies typically have a 7 to 14 day time deductible (waiting period). This means the first 7-14 days of production loss after a covered breakdown are not paid by the insurer. This is longer than typical BI time deductibles (48-72 hours) because minor machinery repairs are expected to be absorbed by the factory.

Does MB cover preventive maintenance costs?

No. MB only covers sudden and unforeseen damage. Scheduled maintenance, routine overhauls, consumable replacements (filters, belts, gaskets), and gradual wear are explicitly excluded. MB is insurance against unexpected failure, not a maintenance cost management tool.

Can I insure only my most critical machines on MB?

Yes. MB allows selective scheduling. You can insure only the machines where failure would halt production or cause the most financial damage. This is a common strategy to manage premium cost: insure the RM5M injection moulding machine but self-insure the RM50K workshop compressor.

How do I reduce my MB premium?

Three strategies: (1) maintain a documented preventive maintenance programme and share inspection reports with your insurer; (2) increase deductibles on lower-value equipment to reduce frequency exposure; (3) maintain clean claims history. A factory with maintenance records, trained operators, and no claims in three years will get materially better rates than one without.

Foundation Conclusion

Fire Insurance covers your machinery from fire, flood, and external damage. Machinery Breakdown covers it from internal electrical and mechanical failure. These aren't competing products; they're complementary layers that together protect your equipment from every direction.

For Malaysian factories where equipment is the backbone of production, running Fire or IAR without MB leaves your most expensive and production-critical assets exposed to the causes of loss that actually happen most frequently: motors burning out, bearings seizing, gearboxes failing.

Talk to our P&E specialists about structuring your factory's complete coverage programme

Unlock Exclusive Foundation Content

Subscribe for best practices,

research reports, and more, for your industry

Want to contact Foundation for your risk or insurance needs?

Insights on Property & Engineering Risks

Practical guidance on construction, industrial, and engineering insurance in Malaysia

Let’s Work Together

If you're managing a construction project, industrial facility, or commercial property in Malaysia and need insurance coverage, we can help structure a program that works.